Dividend stocks for passive income: Your Comprehensive Guide to Financial Freedom

Estimated reading time: 9 minutes

Key Takeaways

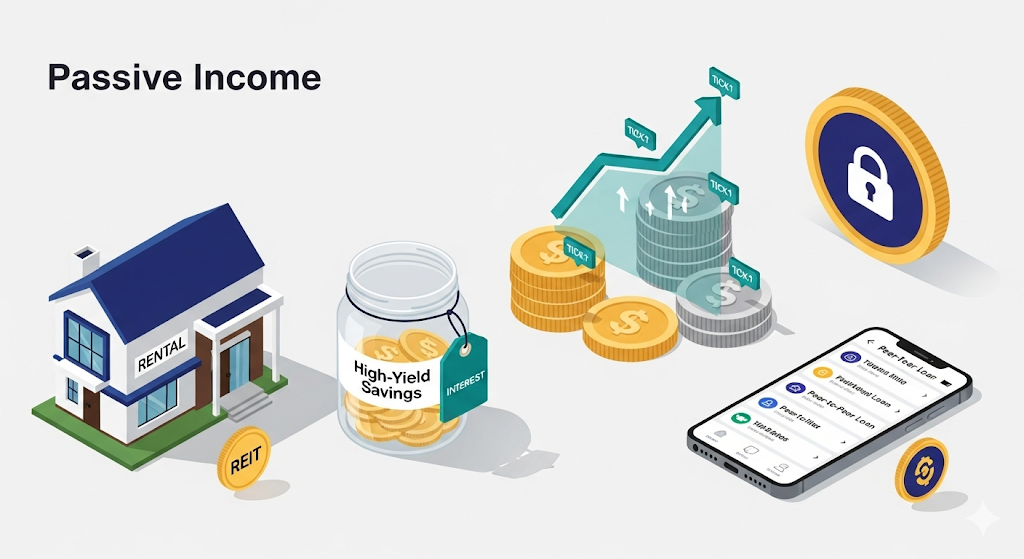

- Dividend stocks can create a passive income stream with minimal day-to-day involvement.

- Diversifying into real estate, crypto staking, and peer-to-peer lending can bolster financial freedom.

- High-yield savings accounts are a low-risk way to safeguard funds while earning moderate interest.

- Patience and consistency are crucial to building sturdy, long-term wealth.

- Financial freedom emerges when reliable income surpasses regular expenses.

Table of Contents

- Introduction: Unlocking Financial Freedom with Passive Income

- Understanding Dividend Stocks for Passive Income

- Real Estate Passive Income Strategies

- The World of Coins and Tokens: Passive Income from Crypto Staking

- Peer-to-Peer Lending Platforms

- The Safe, Steady Base: High-Yield Savings Accounts

- Putting It All Together: Analyzing Your Available Passive Income Options

- Conclusion: Build Your Dividend-Focused Path to Financial Freedom

- FAQ

Introduction: Unlocking Financial Freedom with Passive Income

What truly defines a life free from constant work? It's often about achieving financial freedom. This idea wasn't just a fantasy; many experts recognized it long ago.

Financial freedom means being able to cover your expenses and build wealth without relying on a traditional job for income. It's about creating streams of money that work for you, day in and day out, with minimal effort.

Imagine earning money while you sleep, play, or enjoy your hobbies. This isn't a scene from a sci-fi movie. Passive income is a very real concept offered by the financial world. It’s money earned with minimal ongoing effort or active involvement after you've set it up. Diversifying income streams this way can break the paycheck-to-paycheck cycle and open avenues to what many call “financial freedom.”

https://illegaltoknow.com/passive-income-ideas-for-beginners

Financial freedom is more than just having lots of money. It's about the security and flexibility that comes with reliable income sources. When you have passive income, you can make decisions based on your dreams and priorities, rather than just needing a daily paycheck. These expert resources offer great insight into why passive income is essential and how it fuels financial freedom, building the foundation for your future financial security.

- Definition: Passive income refers to regular earnings generated from sources that require little day-to-day management or effort. This makes it a powerful tool for building long-term wealth without the draining nature of active jobs.

- Significance: Its power lies in enabling financial freedom. Once established, these income streams help cover living expenses, grow your net worth, and allow you to literally buy time back in your life. This is crucial for sustained financial independence.

Here’s what the experts say about these concepts:

- Why Passive Income Is An Essential Part Of Your Financial Freedom

- Unlock Financial Freedom: The Power of Passive Income

- Passive Income and Financial Independence: A Path to Financial Freedom

- Everything You Need to Know About Passive Income

- How to Achieve Financial Freedom

While this guide can't cover every single passive income method available on the internet, we will thoroughly explore several highly effective ones, with a deep focus on methods requiring little day-to-day management. We'll cover:

- Dividend stocks for passive income (our primary focus)

- Real estate strategies often set up passively (Rentals, REITs, Crowdfunding)

- Crypto staking for potential rewards

- Peer-to-peer lending platforms

- High-yield savings accounts

These are popular, practical ways many investors worldwide are building their passive income ladders today. Each has its own character, risk level, and appeal.

Understanding Dividend Stocks for Passive Income

Okay, let's dive into one of the most popular and fundamentally sound ways to create significant passive income: investing in dividend stocks. Think of this as setting up an automatic money funnel that keeps pouring in, helping you reach that desired financial freedom. Many successful investors, like Warren Buffett (who respects companies that can consistently raise their dividends), have built substantial wealth this way.

Dividend stocks are shares (ownership pieces) in companies that decide to regularly share part of their profits with their owners – the shareholders. This profit-sharing comes in the form of cash payments called “dividends,” much like getting paid for just sitting patiently on a special chair. When you own these dividend stocks, you essentially get a portion of the company's success distributed right to your bank account. Why might a company do this? Sometimes to reward loyal shareholders, sometimes to reinvest profits for future growth, or sometimes just because it generates steady cash flow.

This automatic payout system is the magic behind dividend stocks for passive income. Instead of needing to constantly buy and sell stocks (or get rich quick), these companies give you money periodically. The key thing is, these payments usually keep coming regardless of the stock's temporary ups and downs. You're paid based on your ownership, not the market performance of that minute. For people looking to build reliable income, this predictability is incredibly reassuring, especially through a tough economy.

So, how do these dividend stocks for passive income actually help you? Imagine earning a small but regular payment alongside the potential for the stock's value to increase over the long term. This is often called “dividend investing.”

Here are some specific reasons dividend stocks are a popular way to generate passive income:

- They offer a steady, recurring income stream you don't have to actively seek out every week or month.

- They provide retirement income potential, allowing you to supplement other income sources.

- They help you weather market downturns better than purely growth-focused stocks, acting like a financial safety net.

- They potentially offer inflation protection if companies raise their dividends over time.

- Dividend investing encourages a compounding effect, where you earn income on your original investment and even on reinvested dividends.

The True Power: Benefits of Building a Dividend Portfolio

- Steady Payments: Dividends arrive automatically and predictably, making budgeting easier. They smooth out income throughout the year, helping you weather unexpected financial needs.

- Potential for Growth: While waiting for payments, the stocks themselves are likely growing in price. Even giants like Apple and Johnson & Johnson pay dividends while their stock prices have nearly doubled over the past decade.

- Lower Daily Effort: Once you’ve researched the company and bought the stock, the company does the heavy lifting. Your role is mostly oversight, not minute-to-minute market timing.

Did you know the average large-cap dividend stock has historically returned almost as much as growth stocks, while offering more consistent income? Find out more about harnessing passive income through established companies:

https://www.monecoadvisors.com/blog/passive-income-and-financial-independence-a-path-to-financial-freedom

Now, how can you start building your own “dividend diet”? Let’s look at the key actions needed to select reliable partners. Not every stock paying a dividend is worth holding, similar to low-interest credit unions underperforming great savings accounts.

Real Estate Passive Income Strategies: Another Way to Earn Dividend-Like Returns

If the idea of dividend stocks for passive income sounds appealing, you might also be interested in real estate passive income strategies. Millions worldwide manage rentals, REITs, or crowdfunding investments without being hands-on property managers. Real estate passive investing has been a cornerstone of wealth building for centuries.

Real estate itself isn't a stock with dividends, unless you invest through one of these methods. However, real estate passive income strategies exist because owning property often leads to receiving rent payments. This is money earned simply because you own the asset, needing little day-to-day involvement if managed professionally.

Tactics for Real Estate Passive Income Generation

- Owning Rental Properties:

- You buy a house or apartment building.

- You rent it out to tenants.

- You receive the rent money automatically until it needs repairs or the tenant leaves.

- Importance: Usually requires more upfront capital and potentially more management than options like REITs.

- Real Estate Investment Trusts (REITs):

- These are companies that own and manage large portfolios of income-generating real estate (like shopping malls, office buildings, warehouses).

- You buy shares in a REIT, much like buying shares in any other company.

- REITs are required by law to distribute at least 90% of their taxable income as dividends, offering an efficient way to invest passively in real estate.

- Importance: Professionally managed, offers instant diversification for relatively low capital.

- Real estate crowdfunding:

- Platforms (like Fundrise or RealtyShares) allow you to invest small amounts of money in large real estate projects.

- This passive income strategy helps democratize access to real estate investing.

- Importance: Often has lower entry requirements than buying rental property, but check liquidity and risk factors.

https://www.jeniusbank.com/blog/articles/passive-income provides a look at how real estate fits into a well-rounded passive income plan.

Comparing Real Estate Options with Dividend Stocks

| Feature | Owning Rental Property | Real Estate Investment Trusts (REITs) | Real Estate Crowdfunding |

|---|---|---|---|

| Initial Cost | High | Moderate | Moderate |

| Management Effort | High (screen tenants, find repairs) | Very Low (buy and hold) | Medium (depends on platform) |

| Liquidity | Low (can't sell instantly) | High (trade shares like stocks) | Low to Medium (platform lock-in) |

| Income Source | Rent payments | Dividends (approx. 90% of profits) | Dividends/Potential Sale |

| Diversification | Low (owns one building/unit) | Very High (across many properties) | Medium – depends on platform |

| Daily Involvement | High | Minimal | Low-Medium |

Combining dividend stocks for passive income with real estate passive income strategies creates a more robust overall plan. Real estate often performs differently than stocks, especially during economic downturns. Ownership of tangible assets provides a diversification benefit.

https://illegaltoknow.com/make-money-online-ultimate-guide

The World of Coins and Tokens: Passive Income from Crypto Staking

Ready for something entirely different from stocks and real estate? Crypto staking offers yet another avenue for generating passive income, leveraging the digital assets you might explore after building with dividend stocks and real estate. Passive income from crypto staking involves participating in the underlying technology of cryptocurrencies and being rewarded for supporting the network.

Most cryptocurrencies use special rules called “consensus mechanisms” to verify transactions and keep the network safe. Crypto staking is the modern-day term for a system similar to “mining,” but it applies predominantly to a process called “Proof-of-Stake” (PoS).

What Does Crypto Staking Actually Involve?

Imagine having a special digital coin:

- You lock a specific amount of this coin (“stake”) in your digital wallet.

- You agree to follow the network rules for verifying transactions. Different from “Proof-of-Work” mining, which needs powerful computers.

- In return for locking your coins, the network rewards you with more of the same cryptocurrency.

Think of it like this: instead of running expensive mining hardware, you're voting with your coins. The network returns additional coins over time. It's a popular approach for building **passive income** in the crypto world.

Rewards and Potential Returns

- Annual Percentage Yield (APY): The potential returns vary widely. Some newer or smaller coins might exceed 10% a year. Larger coins (like Ethereum post-PoS) might offer 2–10% annually.

- Key Factor: Unlike dividend stocks that typically pay cash, staking rewards you with more coins.

Important Caveats and Risks

- Volatility: Cryptocurrency prices can swing significantly. Gains aren't guaranteed.

- Technology Risk: Bugs, network issues, or forks can cause unexpected losses.

- Regulatory Risk: Changing laws may impact or restrict staking.

- Slashing: If you fail certain network rules, you could lose a portion of your staked coins.

https://www.monecoadvisors.com/blog/passive-income-and-financial-independence-a-path-to-financial-freedom offers more insight into mixing crypto staking with other approaches for a diversified income stream.

Lending to Others Digitally: Peer-to-Peer Lending Platforms

What if you could earn passive income by lending money directly to people through a smartphone? Peer-to-peer lending platforms make this possible, bridging borrowers and lenders seeking potentially higher returns. This passive income approach has grown as finance options expand online.

How Does Peer-to-Peer Lending Actually Work?

- You sign up on a reputable platform (e.g., Lending Club or Prosper).

- The platform lists loans seeking funding.

- You can invest small amounts across many loans for diversification.

- Borrowers repay with interest, creating passive income for you.

By bypassing traditional banks, this direct connection can produce attractive returns. However, it's not risk-free — defaults can and do occur.

Why Consider Peer-to-Peer Lending Among Passive Income Streams — Plus Risks

- Potential Upside: Yields can be higher than other low-risk options, and this method requires minimal ongoing effort once set up.

- Key Downside: Borrower default risk. No government insurance covers your loan if the borrower doesn’t pay.

- Research Needed: Platforms have rating systems and track records. A wise approach is to spread out your investments across many small loans.

The Safe, Steady Base: High-Yield Savings Accounts for Simple Passive Income

Not everyone needs higher-risk or more complex strategies like crypto staking or dividend stocks. A high-yield savings account is a reliable, low-risk foundation for passive income. For those aiming for security, guaranteed returns, and minimal management, this classic approach can anchor your financial freedom roadmap.

Understanding High-Yield Savings Accounts

- Mechanism: You deposit money, the bank lends it out under regulation, and pays you interest for your deposit.

- Yield Advantage: “High-yield” means considerably better interest rates than standard savings. Rates of 4% APY or more might be possible.

- Funds Access: Typically unlimited withdrawals, easy online banking, and FDIC/NCUA insurance.

- Security: Insured up to certain limits, so even if the bank fails, your money is protected.

Compound Growth is modest but steady. If you’re risk-averse or just diversifying, these accounts provide peace of mind.

https://illegaltoknow.com/passive-income-ideas-for-beginners

For more on blending different assets, see this resource.

Putting It All Together: Analyzing Your Available Passive Income Options

You've heard about several passive income methods. How do you compare them and decide which to pursue? Here’s a quick summary:

Benefit/Drawback Breakdown of All Strategies

- Dividend Stocks

- Pros: Regular payments, potential for increased payouts, encourages long-term investing.

- Cons: Market volatility, requires understanding company fundamentals, potential payout cuts.

- Real Estate

- Pros: Tangible asset, rent can outpace stock dividends, possible inflation hedge.

- Cons: High initial capital for direct ownership, illiquid, management hassles (though REITs reduce effort).

- Crypto Staking

- Pros: Potentially high annual returns, different market than stocks, relatively low barrier to entry.

- Cons: Volatile prices, tech/regulatory risks, possible slashing.

- Peer-to-Peer Lending

- Pros: Potentially higher returns than traditional banking, easy to diversify small amounts.

- Cons: Borrower default risk, less liquidity, no FDIC insurance for defaults.

- High-Yield Savings

- Pros: Very safe, insured, easy access, guaranteed interest.

- Cons: Lowest returns among these options, inflation may outpace interest if rates are too low.

Choosing Your Passive Income Portfolio

- Risk Tolerance: Higher risks can come with higher rewards. Review your comfort level.

- Desired Yield: Immediate high returns vs. steady long-term growth. Choose accordingly.

- Time Commitment: Rental property can be more hands-on; REITs or high-yield savings require less effort.

- Level of Understanding: Knowledge of the stock market, real estate, or crypto influences your decision.

The Crucial Role of Diversification

Diversification means mixing multiple income sources. If one underperforms, others may keep you afloat. Even for a simpler approach, “not putting all your eggs in one basket” is a tradition for a reason.

https://illegaltoknow.com/passive-income-ideas-for-beginners and

https://illegaltoknow.com/make-money-online-ultimate-guide reinforce why multiple strategies form a backbone for financial security.

Conclusion: Build Your Dividend-Focused Path to Financial Freedom

So, dividend stocks for passive income aren’t some mystical elixir but are one powerful component in a bigger plan, complemented by other methods like real estate, crypto staking, peer-to-peer lending, and high-yield savings. Building true financial freedom involves stacking multiple reliable income streams.

Achieving independence where you no longer rely on a traditional job to cover everyday expenses demands patience, discipline, and due diligence. Kickstart your journey by making small investments in the strategies you’re most comfortable with.

Final Thoughts

Whether it's dividend stocks, real estate, or crypto, the core principle remains: diversify and play the long game. What begins as a trickle of income can grow into a steadily flowing stream that funds your lifestyle — giving you the freedom to spend your time how you choose.

Disclaimer: This information is for educational purposes only and does not constitute financial advice. Always conduct your own research or consult a qualified professional before making investment decisions.

For additional reading on passive income:

- Why Passive Income Is An Essential Part Of Your Financial Freedom

- Unlock Financial Freedom: The Power of Passive Income

- Passive Income and Financial Independence: A Path to Financial Freedom

- How to Achieve Financial Freedom

FAQ

Q1: How do dividend stocks generate passive income?

Dividend stocks pay out a portion of the company’s profits to shareholders. As long as you hold the stock, you receive dividends according to the number of shares you own.

Q2: Which is safer, real estate or dividend investing?

Both carry risks. Real estate can be more illiquid and capital-intensive, while dividend stocks can fluctuate with the market. Diversifying across both often helps manage risk.

Q3: Is crypto staking too volatile for beginners?

Crypto staking can be volatile. Beginners should research the technology, regulatory environment, and potential risks thoroughly before committing funds.

Q4: How do peer-to-peer lending platforms handle defaults?

Most platforms have rating systems to assess borrower risk. If a borrower defaults, you'll generally lose that portion of your investment. Some platforms have reserve funds, but there’s no guarantee of protection.

Q5: Are high-yield savings accounts good for long-term investing?

They’re extremely safe but typically offer lower returns than stocks or real estate. They’re best for short-term needs or as part of a balanced approach.