Passive Income Ideas for Beginners: Build Wealth While You Sleep

Estimated reading time: 12 minutes

Key Takeaways

- Passive income allows you to earn money with minimal ongoing effort once you’ve set up your systems.

- Beginners can start small through methods like affiliate marketing, blogging, digital product sales, and more.

- Diversifying across multiple passive streams helps reduce risk and increase overall stability.

- Patience and initial effort are critical; it’s not about “getting rich quick” but building sustainable, long-term income sources.

Table of Contents

- Title: Passive Income Ideas for Beginners

- Key Takeaways

- Passive Income vs Active Income

- How to Earn Passive Income Online

- Top Passive Income Ideas for Beginners

- Rise of New Passive Income Streams for 2025

- Make Money in Your Sleep

- Getting Started: Steps for Beginners

- Common Mistakes to Avoid

- Conclusion: Your Journey Starts Now

- FAQ

Have you ever dreamed of making money without showing up for the nine-to-five? That's the magic of passive income. Passive income ideas for beginners can seem daunting, but essentially it’s about earning from assets or activities that require minimal ongoing effort once established. Unlike traditional work-for-pay (active income), you don’t need to be actively “on the job” to receive money.

In today’s world, having a steady flow of passive income isn’t just a millionaire fantasy anymore. It’s a realistic way to avoid burnout, build financial security, and potentially achieve true financial freedom – the ability to choose how and when you work without being dependent on a single paycheck.

This blog post is your comprehensive guide to understanding passive income ideas for beginners. We’ll break down the core differences between passive and active income, explore online and offline methods suitable for starting out, highlight what might be the best passive income streams 2025, and provide actionable steps. We even touch on strategies aimed at “making money in your sleep.” Let’s dive in and learn how you can build wealth passively!

Passive Income vs Active Income

To build successful passive income streams, you need a clear understanding of how they differ from more traditional earnings. Let’s define these two types of income:

- Passive Income: Money earned from sources that are mostly hands-off once set up. Think of owning a rental property, collecting dividends from stocks, or selling a digital product. The key is minimal ongoing involvement after the initial setup.

- Active Income: Traditional income where you directly trade time for money (e.g., salaries, hourly wages, or commissions). Your presence and effort are required to keep earning.

This distinction highlights the mindset shift needed to move from “active” time-for-money toward “passive” asset-based income—a crucial step on the path to financial independence.

How to Earn Passive Income Online

The internet is a goldmine for creating low-effort passive income streams. Here are several beginner-friendly methods:

- Affiliate Marketing: Earn commissions by promoting products or services on your blog, website, or social media. When readers click your unique link and purchase, you get paid.

- Creating and Selling Digital Products: Design something once—like e-books, templates, photography presets, or royalty-free music—and sell it repeatedly. Platforms such as Etsy, Gumroad, or Amazon Kindle Direct Publishing handle the transactions while you collect the royalties.

- Blogging & Ad Revenue: Start writing about a niche you love. Once you build traffic, monetize with Google AdSense, sponsored posts, or affiliate links. Passive income flows as ads and affiliate mappings keep working around the clock for you.

- Online Courses & Webinars: Record a class once and let platforms like Udemy or Teachable sell it repeatedly. For example, see this guide on broader online entrepreneurship strategies. Once set up, the revenue becomes relatively hands-off.

- Peer-to-Peer Lending: Lend small amounts of money to borrowers through platforms like LendingClub or Prosper, earning interest in return. It can be a passive approach to investing, but remember there’s default risk, so always do your research.

Top Passive Income Ideas for Beginners

The best, easiest passive income ideas for beginners usually balance low startup barriers with solid growth prospects. Let’s take a deeper look:

- Dividend Investing: Buy shares of companies that pay regular dividends. Open an investment account (Vanguard, Fidelity, etc.) and research stable dividend stocks or funds. Over time, you’ll earn payouts that can be reinvested to compound returns.

- Real Estate Crowdfunding: Invest in property projects via sites like Fundrise or RealtyMogul. Pooling funds with other investors to buy a fraction of larger real estate deals can generate passive rental or appreciation income—no landlord duties required.

- YouTube Content Channel: Post videos consistently around a niche. Monetize with ads, sponsorships, or affiliate links once you have enough views and subscribers. Videos can continue earning from old uploads, making it a powerful passive strategy over time.

- Writing eBooks: Self-publish on Amazon Kindle Direct Publishing. After your book goes live, sales require little extra work. Royalties trickle in from each sale. Just make sure you promote effectively at the start to build visibility.

- Developing Mobile Apps: Use “no-code” platforms or your own coding skills to create simple apps that solve a small problem or entertain. Monetize with in-app purchases or ads. Once the app is built and launched, it can require minimal upkeep to keep earning.

Rise Of New Passive Income Streams For 2025

As technology evolves, new avenues for passive income emerge. Here are some forward-looking strategies:

- Cryptocurrency Staking: Lock up your crypto (like Cardano or Tezos) to help secure the network and earn staking rewards—an automated way to generate returns, though subject to crypto market volatility.

- NFT Investments: Buy unique digital assets hoping their value rises. Some NFTs grant passive royalties if the token design includes it. Highly speculative, so research thoroughly before diving into NFT projects.

- Automated Dropshipping: Set up a Shopify-based store that forwards orders to suppliers, removing yourself from fulfillment. Automated apps exist to handle much of the process once customers click “Buy.”

- Subscription Boxes & Content Clubs: Offer recurring memberships—digital or physical—to people who value convenience or curated experiences. The recurring revenue model can be a big win for stable monthly income.

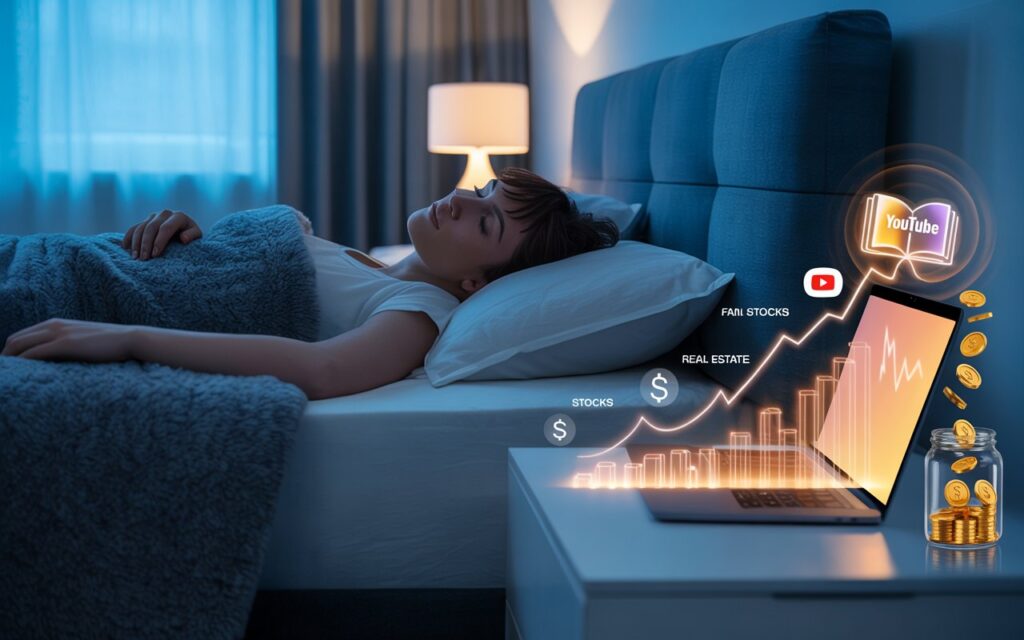

Make Money in Your Sleep

“Make money in your sleep” is a popular phrase that points to the essence of passive income. Key elements include setting up automated sales funnels, integrating scheduling tools for content releases, and reinvesting to multiply gains.

Automation is crucial: let Mailchimp or ActiveCampaign handle email drip campaigns day or night, direct leads to your digital products, then watch sales occur while you rest. Similarly, tools like Buffer let you queue up social posts. Over time, your presence becomes less vital to daily operations.

Reinvest Earnings is also a big factor. If you find success in affiliate commissions or eBook sales, funnel that money into dividend stocks, property shares, or better marketing. Over time, compounding occurs, eventually generating meaningful returns—even when you’re asleep.

Getting Started: Steps for Beginners

Ready to embark on your passive income journey? Here’s a practical checklist to guide you:

- Self-Assessment: Evaluate your skills, interests, available capital, and time. Choose a niche where you can apply the knowledge you already have.

- Idea Selection: Focus on one or two methods at first—like blogging or digital product creation—to avoid spreading yourself too thin.

- Initial Setup: Invest the necessary money and time to create a foundation. Whether that’s building a small website, setting up an investment account, or recording an online course, you need to put in effort before it can become passive.

- Goal Setting & Tracking: Define realistic financial targets and measure progress to decide when or how to scale up. Keep an eye on stats, ROI, and your time investment.

- Consistency & Reinvestment: Commit to regular action and plow profits back into your system—buy more assets, improve your product, or learn new marketing skills. Compounding is your friend.

Common Mistakes to Avoid

- Spreading Too Thin: There are many potential passive streams, but doing too many at once can reduce effectiveness and cause confusion.

- Insufficient Research: Don’t jump into any platform or investment without reading reviews and understanding how it works. “Overnight success” stories often leave out extensive prep and risk management.

- Neglecting Upfront Costs: Passive doesn’t mean zero time or zero capital. Be honest about the expenses (in money and effort) required for your chosen path.

- Poor Tracking: If you aren’t measuring what’s working, you can’t optimize. Use spreadsheets or bookkeeping tools to see whether your platform generates real returns.

- Unrealistic Expectations: Passive income rarely appears immediately. Building momentum can take months or years—plan for the long haul and stay patient.

Conclusion: Your Journey Starts Now

Passive income isn’t a get-rich-quick scheme. It’s a disciplined move toward financial independence, where assets you create or invest in do the heavy lifting. With passive income ideas for beginners ranging from affiliate marketing to crowdfunded real estate, there is something to fit most skill sets and budgets.

Whether you plan to jump into YouTube or dividends or aim for best passive income streams 2025 like crypto staking, the key remains consistent effort up front and ongoing refinement. Equip yourself with the right tools, knowledge, and mindset to see meaningful returns over time.

It’s not about doing everything at once—just pick one or two methods, learn, and optimize. Even small, steady successes can eventually grow into a life-changing snowball with enough patience.

Additional Resources

- Books: “Rich Dad Poor Dad” by Robert Kiyosaki, “The Passive Income Playbook” by Pat Flynn, “The Automated Customer” by Peter Clark.

- Courses: Look for specialized “passive income” or “affiliate marketing” courses on Udemy, Teachable, or Coursera if you need step-by-step guidance.

- Tools & Websites:

- Teachable & Udemy for hosting courses.

- Shopify for dropshipping or e-commerce automation.

- Fundrise & RealtyMogul for real estate crowdfunding.

- Amazon KDP for eBook publishing.

FAQ

1) What is passive income?

Passive income refers to earnings generated from ventures that require minimal daily involvement once established, such as real estate rentals, dividends, or digital product sales.

2) Do I need a lot of money to start?

Not necessarily. Many methods, like blogging or creating digital products, require little up-front capital. Even investing can start small through fractional shares or low-minimum platforms.

3) How long does it take to see results?

It varies. Some people see small wins in a few months, but significant income often takes longer. Success depends on your chosen method, effort, and market demand.

4) Can passive income truly happen “while I sleep”?

Yes. Once your systems or investments are set up—such as automated course sales, app downloads, or dividend payouts—money can indeed flow in overnight with minimal direct action.